An appraisal is crucial for estate planning as well as valuation for tax purposes. It is always best to have an accurate and up-to-date appraisal when any property is involved.

Having a current appraisal helps you keep better track of your financial assets rather than estimating from an outdated appraised value. Properties can often increase in value, and they can decrease just as easily.

ESTATE PLANNING

For estate planning, appraisals can help determine the values of assets. This knowledge is indispensable for heirs if properties and assets need to be gifted or divided after a death.

Keeping an up-to-date appraisal on file is also handy when determining the increase of property value as well as growth or loss margins. Being able to see steady growth or loss over time can help determine proper selling and buying values for good investment opportunities.

ESTATE TAXES

Appraisals are also helpful for estate tax purposes. Having an accurate appraisal can help in the case of a tax audit. Many privately owned businesses are required by the IRS to have an appraisal for determining values if claimed on tax returns.

Appraisal costs are often tax deductible, so check with your tax preparer to determine if that works in your situation.

WE LOOK FORWARD TO ASSISTING YOU IN YOUR APPRAISAL NEEDS. CONTACT US TODAY FOR A PROFESSIONAL AND ACCURATE APPRAISAL.

WE BID EVERY PROJECT. CLICK AN ICON TO LEARN MORE ABOUT OUR APPRAISAL SERVICES.

Selections From Our Monthly Newsletter

2032A ESTATE VALUATION

by Mason Spurgeon, Certified General Real Estate Appraiser

April 2018

No one ever wants to deal with the IRS, and they especially don’t want to over-pay them. I remember a funny quote from Ron Paul: “Don’t steal! The Government Hates Competition,” and I know that’s how most of us feel. The IRS is a huge bureaucracy that very few want to question, but with the right help, loopholes within the tax code can be used to reduce your tax burden, legally. One of the ways your tax burden can be reduced is through the 2032A, Special Use Valuation.

The Internal Revenue Code Section 2032A, Special Use Valuation is a valuation method used in figuring the federal taxes for an estate. An appraiser normally values a property according to its fair market value (what the tract would sell for on the open market). However, with a 2032A valuation, the value is based on the property’s current use. This can typically reduce the value of the land and in turn reduce the tax burden. This all sounds great, but with the IRS there are always technicalities.

The first task is making sure that the real estate qualifies for the 2032A Valuation election. There are several rules that dictate if a property applies. The list below summarizes requirements from the IRS website.

The decedent (the person who has died) must be a US citizen.

The real property must be in the United States.

The property must have been used by the decedent or family member for farming in a qualified manner for 5 out of the last 8 years.

Property must pass to a qualifying heir.

The farm assets, both real and personal, must compose at least 50% of the estate and the real property must compose at least 25% of the total value of the adjusted estate.

If these conditions are met the executor can elect to use the 2032A Special Use Valuation. There are still several steps and forms to be completed before the taxes can be filed. One of the most important steps is getting a real estate appraisal from a qualified real estate appraiser.

The appraiser should start by finding comparable properties in the immediate market area that are currently leased and have been leased on a cash-rent basis for the past five years. The comparable rental property must be very similar to the subject property in location, productivity, and all other aspects, if possible. The five-year cash rental data is then averaged on a per-acre basis along with the five-year annual real estate taxes, local, state, and federal taxes, which are deducted from the cash rent. That value is then divided by the average annual effective interest rate of all new Federal Land Bank loans. The image below gives an example:

While this number does appear to be high as a price-per-acre, it is much lower than the market value which is $13,400 per acre. This is a huge reduction in the value used to figure taxes for the estate. The difference between the fair market value and the special use valuation becomes the amount of the lien that can be recaptured.

That brings us to the downside of using this type of valuation. The step-up in value for the real estate basis as of the date of death will be the special use value, not the fair market value. This could create a large tax burden for the heirs if the property is sold after the 10-year period. A tax professional, such as a lawyer or accountant, should be contacted to help with any of your future estate planning or questions about filing a 2032A Special Use Valuation with the IRS. Spurgeon Appraisals would be happy to help with the valuation/appraisal side of the process.

Just remember when selecting a real estate appraiser, the lowest cost or the quickest completion time is not always the best. Real estate appraisers are not all created equal, and an appraisal is only as good as the data used in the report. At Spurgeon Appraisals, we take the time to find and confirm the best and most recent data available. Call or email us today with any questions you may have about your pending project.

Spurgeon Appraisals regularly appraises a variety of property types. We have experience appraising farms, residences, and commercial properties. We pride ourselves on providing excellent customer service and quality appraisals. Contact our team to see how we can meet your appraisal needs and exceed your service expectations.

THE VALUE OF MULTIPLE VALUES

by Stan Choate, Appraisal Tech / Valuation Associate

April 2016

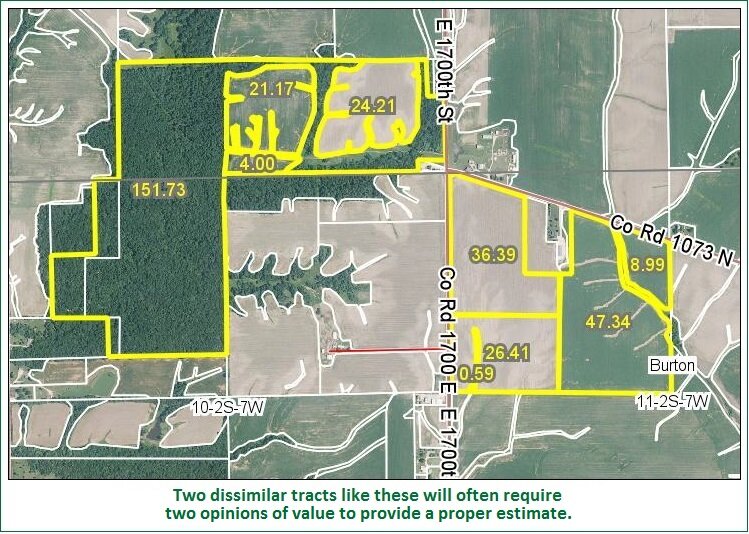

Sometimes, the most difficult part of the appraisal process is determining how many opinions of value are needed. The question seems simple enough, but it is complicated by two factors. The first complication arises because customers, being new to the appraisal process, are not entirely sure how to make that decision, and they probably did not know it would be a factor. The second complication, which is the topic of this newsletter, is the limitations of a single opinion of value.

One opinion of value can only tell the customer so much about the property’s market value. That one opinion of value can separate the value of buildings from the value of the land, and it can separate the value of different land classes from each other. But that one opinion value cannot separate the value of one tract of land from another. It also cannot tell the market value of a property at two different effective dates. Ultimately, that one opinion of value can only give one estimate for an entire property at a narrow point in time.

In order to see distinct market values for distinct tracts of land, multiple opinions of value are usually needed. If you want to know the value of a 200-acre tract which is 25% tillable, and also know the separate value of a 120-acre tract which is 95% tillable, then you need two opinions of value. That is true even if the two tracts are close, or even contiguous. And if you decide that you also want to know the value of another 75-acre timber tract, that will require a third opinion of value.

The same principle holds true for appraising one property at multiple effective dates. Most customers understand that the market value of a property changes over time. In order to determine the difference in value between date A and date B, the appraiser must analyze sales of comparable properties for both dates. It may be only one property, but it is practically the work of two appraisals, because the amount of sales research needed is doubled.

When placing an appraisal order, the appraiser should help the customer determine, clearly and decisively, how many opinions of value are needed at the beginning of the project. For one thing, it affects fee: more opinions of value will require more work and will therefore most likely cost more. Also, if the appraiser prepares only one opinion of value when more were needed, he will inevitably be asked to do the project over again, which will waste time for the customer and possibly cost more money as well. Time and money are saved by making the right choice on these matters at the beginning of the process.

The intended use of the appraisal plays a large factor in making these decisions. When banks are looking to refinance a loan, they often request a single opinion of value on multiple tracts of land. That suits the intended use well enough, because all they need is that one total market value. On the other hand, multiple opinions of value will almost always be needed when a family wishes to divide various tracts among themselves in a way that equally distributes the value of those tracts. Another case requiring multiple opinions is when the customer wants a single tract valued as of different effective dates, such as for tax purposes: one opinion of value is needed per date.

LESS THAN THE SUM OF THE PARTS

by Stan Choate, Appraisal Tech / Valuation Associate

September 2015

A real estate appraiser is typically expected to appraise one thing: real estate. Houses, lots, farms, and buildings are commonly considered the only proper objects of their work. The idea that anything else would be relevant to an appraisal can be surprising to their clients and might even be viewed as suspicious. However, appraising real estate is not always as simple as looking at the dirt and bricks. Other factors do occasionally play a decisive role in the appraisal.

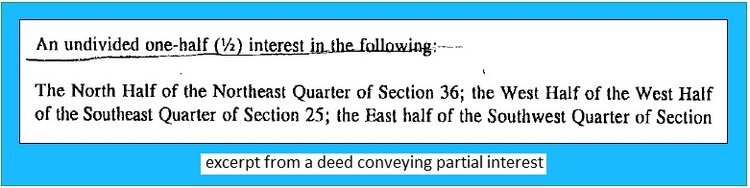

One such example is the idea of “interest.” This term is from the legal jargon which has developed around the ownership of real estate. The owner of a property, if he is the sole owner and has sole power over it, owns “fee simple interest” in a property, usually just called “fee simple.” Husbands and wife typically have that interest as “tenants in common.” Those are probably the most common forms of ownership and interest. However, many properties are not owned by one person, nor even by a husband and wife: they have co-owners of some sort. Various concepts have therefore developed to describe the many forms of co-ownership and their legal implications.

“Fractional interest” is one of those concepts. In cases when a property has multiple owners, they are often described as each having a fractional interest in the property. This may be expressed as a percentage or as a fraction. A farm may have three owners, each having a one-third interest in the property. Another property might have three owners as well, but one of them owns 50% interest while the other two own 25% each. The matter becomes even more complex when one of the owners (but not all of them) wishes to sell his interest to someone else. The property then remains in the ownership of the other owners, but a new owner comes in with the fractional interest he just purchased. Something similar happens when one of the owners dies and leaves his own interest to an heir.

Appraisers are sometimes involved in these transfers, and in such cases they may need to appraise the fractional interest being transferred. To many, this does not seem that difficult. They think, “Just take the market value of the property, divide it by the amount of interest, and you’re done.” This method is simple and intuitive, but not at all accurate to how the market treats fractional interest. A normal market buyer actually does not want to pay as much for a fractional interest, because such a property comes with strings attached—strings held by other owners. And so, the market value of a fractional interest is usually less than the dividend of the property and amount of interest. The appraiser must determine exactly how much less, or else he cannot give a reliable market value.

Dealing with fractional interests can be a tricky matter. We suggest that all of our clients consult a title company or attorney when questions arise on such issues. But for the actual appraisal, Spurgeon Appraisals is familiar enough with fractional interests that we do not shy away from appraising them. We have always tried to develop the expertise necessary to meet the needs of our clients, whatever they may be.

SURVEY SAYS...

HIGHER QUALITY AND GREATER EFFICIENCY

Stan Choate, Office Manager

September 2019

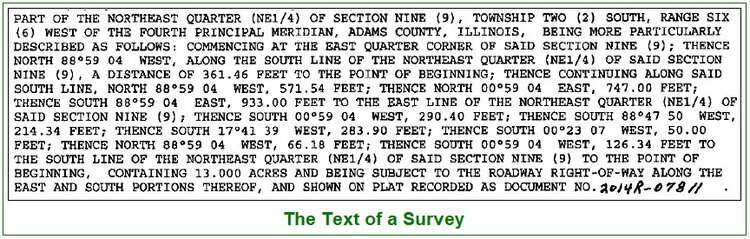

Land surveyors have a very different job than real estate appraisers, but the work of the former is very often a great help to the latter, as we have come to learn at Spurgeon Appraisals. The surveyor’s job is to determine the boundaries, area, and other characteristics pertaining to a piece of land. Therefore, the surveyors help the appraisers answer the two questions they most often ask their customers about properties: where is it, and how big is it?

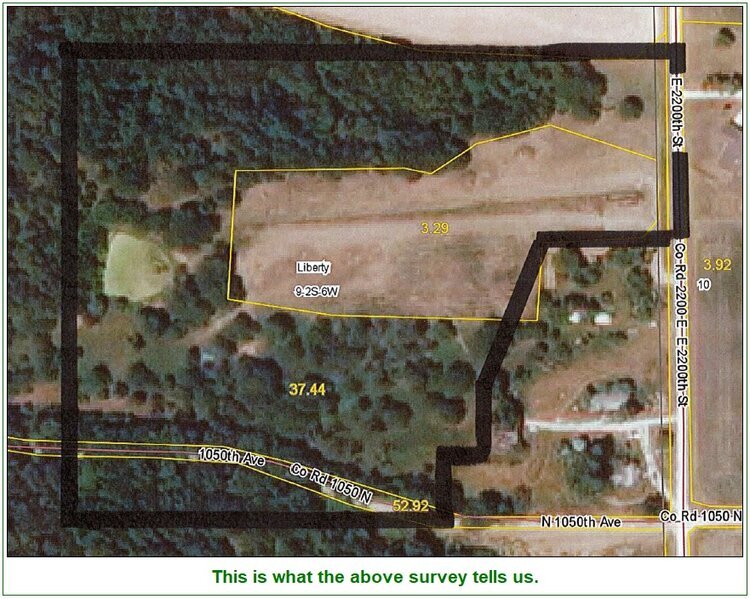

Most properties have never been surveyed or have not been surveyed recently enough to benefit from modern technology and methods. For this reason, properties are usually identified by the appraiser using older-style legal descriptions, county plat maps, or GIS maps. These are usually sufficient, but they are very crude compared to a modern survey, which precisely shows property boundaries and acreage, even for properties of irregular shape. Modern surveys are so rare and so desirable that we feel like we’ve struck gold when our clients provide us with one.

The great benefit of a modern survey explains some of the requests we make of our customers. Even before we bid a project, we often ask whether the property has been surveyed—and if so, whether the survey can be provided to us. Clients will also notice that we might be reluctant to bid a project or begin our work until we have reviewed the survey. We have learned from long experience that the survey answers many questions necessary for fairly bidding a project and completing it with the utmost accuracy.

Surveys are especially useful for appraising a property subdivided from a larger property. This often happens when a property owner is selling a portion of his land, or when a large estate is being divided among heirs. We are often asked to appraise such properties, but the customer does not yet know how much land will be transferred or where the boundaries will be—two pieces of knowledge required for an accurate appraisal. Without the survey, the customer very often cannot describe the property well enough for us to determine the appraisal fee, let alone begin the appraisal. Furthermore, we have often seen landowners and executors change their minds about the exact size and dimensions of a property, even after they have ordered the appraisal. Waiting for the completion of the survey will give the appraiser something concrete to use.